Selected Projects

Botswana PSP Strategy

The objectives of this assignment were to produce a private sector participation strategy in BPC and Botswana’s Electricity Supply Industry. PEEPA will use this as support for providing on-the-job training to PEEPA staff on core privatization skills illustrated by the BPC case.

Nigeria Baseline Losses Support

We are advisors on regulatory, tariff, commercial and power market matters to the management and shareholders of many of the Electricity Distribution Companies in Nigeria. Support during the Baseline Loss study included fieldwork within the Discos’s franchise zone.

UK Fuel Price Forecasting

In partnership with Heriot Watt University, we investigated the suitability of using a customised copula to capture the interdependency between fossil fuel prices. The copula will be used by the UK Department of Energy and Climate Change (DECC) to generate correlated samples around the central fossil fuel price projections for use in Monte-Carlo modelling to understand the uncertainty around fuel price projections based on historic data.

Cyprus Privatisation of EAC

This project included the assessment of all possible scenarios and options regarding the future structure and ownership regime of EAC. We examined the retention of the EAC as a vertical integrated entity but with appropriate accounting separation and functional unbundling in place for its five current functions (either state controlled or privatized).

Mexico Solar IPP Development

The Mexican power system operator – CENACE – initiated a competitive tender process in December 2015 for the long-term (20-year) procurement of electricity exclusively from clean energy generators. MRC was hired by a Spanish solar power developer to assist in determining a competitive commercial and pricing structure for submission in the competitive bid that would allow for a profitable return on the consortium’s investment in the projects.

Pakistan Strengthening of CPPA

The license of the National Transmission and Dispatch Company (NTDC) was amended in May 2015 to separate the market settlement function to an independent Central Power Purchasing Agency Guarantee Limited (CPPA-G). The Market Operator Rules and the Commercial Code were approved by the Government and the National Electric Power Regulatory Authority (NEPRA) to govern the commercial transactions of the power market.

Brazil Water & Sanitation

The objective of these assignments was to prepare companies for the regulated environment. We performed studies recommending best national and international regulatory practices and proposed methodologies and support during the tariff setting process.

Brazil Assistance to EDCs

The objective of these assignments was to assist the (EDCs) to determine the revenue requirements of the companies and the end-user tariffs that will allow recovering the efficient operation costs of service (OPEX and CAPEX) during the 1st, 2nd and 3rd Tariff Setting Periods.

Brazil Electrical Energy Sector

This project had great significance on the energy sector. We reviewed and recommended the best international practices and the problems related to the Brazilian tariff structure and recommended proposals to improve the actual tariff structure.

Andean Community Electricity

The Inter-American Development Bank (IDB) engaged us to work on the regional electricity integration of all participating countries, to maximize the economic benefits of the whole region.

Mexico Economic Optimization

We provided recommendations and proposals for the new market structure proposed by SENER. This included the analysis of the following aspects; Regulation and payment process required to ensure continued operation of the electricity sector during the transition process; market regulations and other transitional rules; financial flow projections among the CFE business units, end users and other players in the electricity sector.

Philippines Regulatory Reset

We have been providing advisory services to the Energy Regulatory Commission of the Philippines for several years for different regulatory resets involving different regulated entities. Among the projects we have undertaken for the Commission includes: Development of the Optimised Depreciated Replacement Cost Handbook for Private Distribution Utilities; Review of the Historic, Budget and Forecast Expenditure of the National Grid Corporation

New Zealand RAB Valuation Review

Three separate reviews were undertaken for the Commerce Commission of New Zealand in relation to the Regulatory Asset Base (RAB) Valuation and Asset Adjustment Processes of Electricity Distribution Businesses (EDBs) and Gas Pipeline Businesses (GPBs).

Toolbox For Renewable Energy Tariffs

EMRC developed a toolbox consisting of several standard tariff models to calculate tariffs for renewable energy technologies. Models from the toolbox will be successfully adapted and used to calculate renewable energy tariffs for the Economic Community of West African States (ECOWAS) member States.

Tariffs for Off-Grid Renewable Energy

EMRC developed a conceptual framework and decision-making tool for designing user charges for off-grid energy solutions and determining appropriate subsidization/incentive in Tanzania.

Lesotho Cost of Service & Tariff Study

MRC Group is close to completing a comprehensive Cost of Service and Tariff for the Lesotho Electricity and Water Authority (LEWA). The objectives are twofold: Firstly, to set electricity tariffs to promote economic efficiency and ensure financial viability. Secondly, to provide a basis for the transition from existing tariffs to economic cost reflective tariffs.

Turkey Energy Market Development

The Project is part of the second MIPD (IPA Multi-annual Indicative Planning Document 2011-2013) with the objective of “further alignment with and implementation of acquis on the internal gas and electricity market”. Within this framework, MRC assisted MENR in a series of studies on the harmonisation of electricity and natural gas laws following the adoption of the EU Third Energy Package.

UK Gas Market Study

EMRC conducted a feasibility study for entry to the UK gas market considering demand, supply, prices and contracting models) and the necessary legal and regulatory clearances.

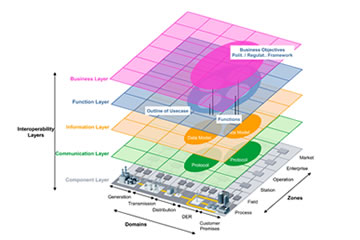

Turkey's Smart Grid Road Map

In the Turkish Electricity Distribution Sector, transformation of the electricity distribution network infrastructure has started, along with major changes like privatization, unbundling of distribution companies and supply/retail companies and steps taken for liberalization of the market. The sector is now getting ready to pass another major milestone with the Turkey Smart Grid 2035 project.

AYEDAS EDCo Network Master Plan

AYEDAS is one of the electricity distribution companies in Turkey, covering 4 regions. AYEDAS covers 17 (154kV/MV) power substations with 5.200MVA total capacity, 2.975 distribution transformers (MV/LV) with total capacity of 5.396MVA, and 2.326.437 subscribers with 10.266.851 MWh energy consumption of the Turkish electricity distribution market.

Network Master Plan for Boğaziçi Electricity

BEDAS is an electricity distribution companies in Turkey covering 32 (154kV/MV) power substations with 8225MVA total capacity, 13.000 distribution transformers (MV/LV) and 4.300.000 subscribers with 24.000.000 MWh energy consumption of the Turkish electricity distribution market. MRC Turkey was selected by BEDAS to carry out the Master Plan for the development of the Electricity Distribution System that will be the road map for BEDAS in the short, medium- and long-term.